On 5 December 2019, Alexey Miller, CEO of Gazprom, and Ölziisaikhany Enkhtüvshin, deputy Prime Minister of Mongolia, signed a Memorandum of Understanding for joint assessment of the project viability of the new gas pipeline to China through Mongolia, reports Gazprom. Although running a longer distance, the trans-Mongolian gas pipeline would be less technically challenging compared to the existing project of the “Power of Siberia 2” pipeline through the Altai mountains via the so-called Western route.

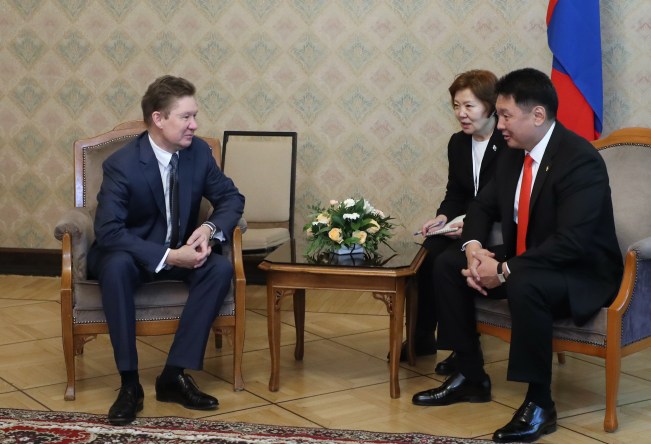

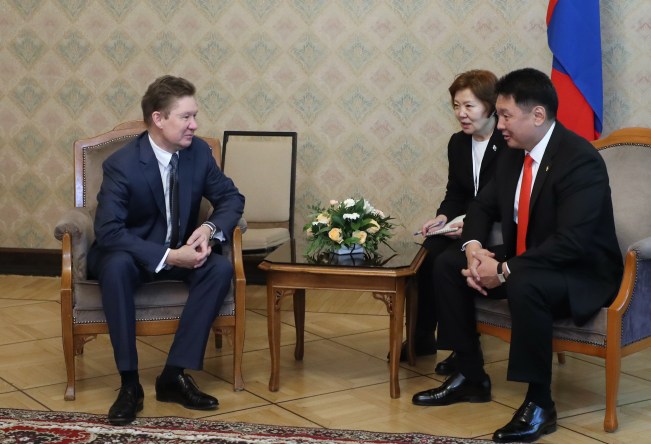

On 3 December 2019, Ukhnaagiin Khürelsükh, the Prime Minister of Mongolia, expressed his support for this project. “We are glad that Russia supports the project of the gas pipeline through Mongolia to China. I think that today we have seen the start of this project,” said Mr Khürelsükh during the press conference after meeting with his Russian colleague Dmitriy Medvedev. Later that day Mr Khürelsükh met with Alexey Miller to discuss cooperation prospects in the field of natural gas exports.

Meeting of Gazprom Chairman Alexey Miller and Prime Minister of Mongolia Ukhnaagiin Khürelsükh. Image credit: Gazprom

The Ministry of Energy of Russia and Gazprom will create a task force to work on the project of the gas pipeline through the territory of Mongolia, confirmed Alexey Gordeev, deputy Prime Minister of Russia. “It has been announced that the task force is formed, it will work on the technical and economic assessment of the project. The main factor is the project’s viability. Russia will assess this project on the presidential level, the respective instructions were given to both the Ministry of Energy and Gazprom,” said Mr Gordeev, cited by Interfax news agency.

Construction of the “Power of Siberia” gas pipeline. Image credit: Gazprom

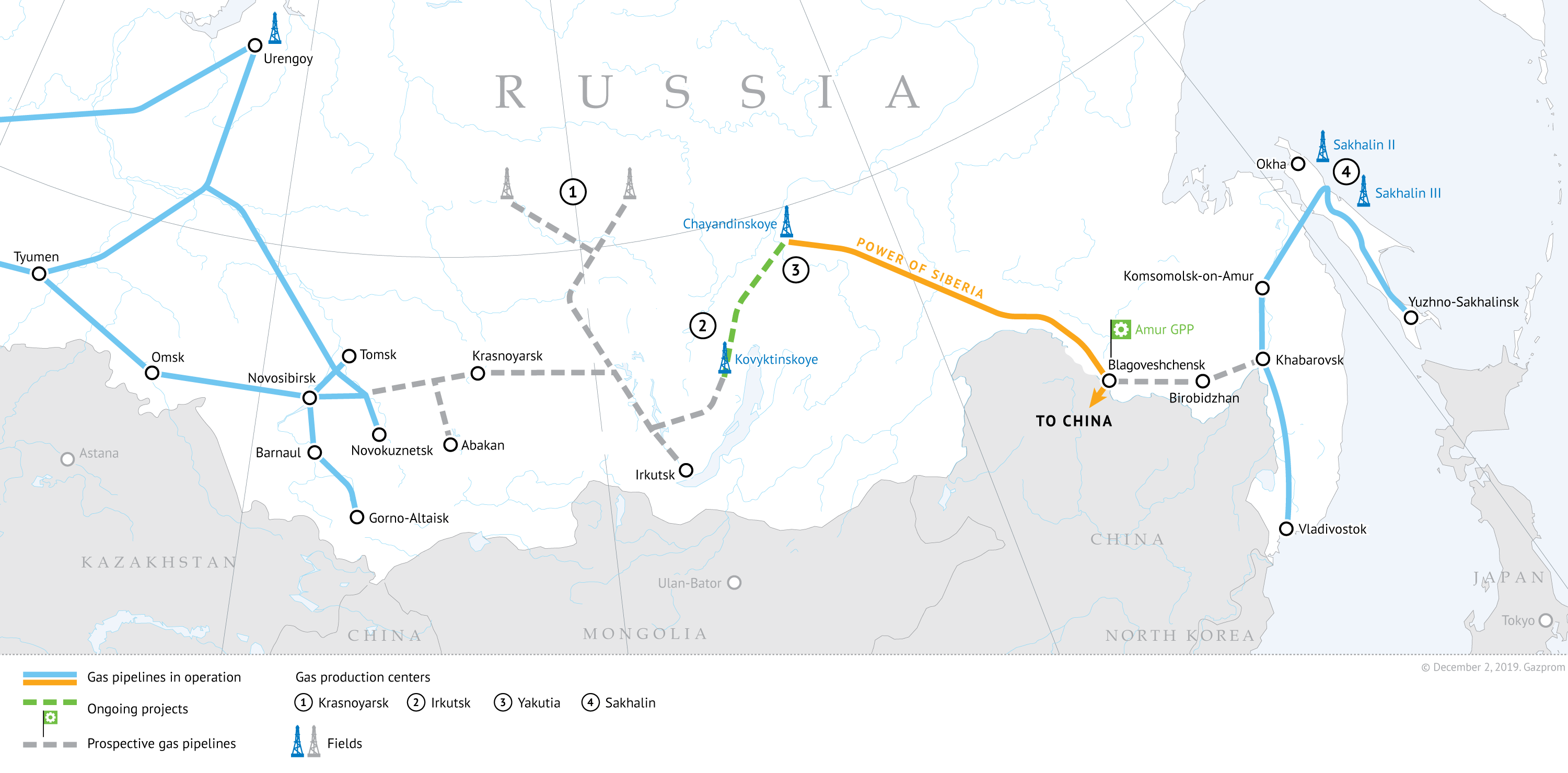

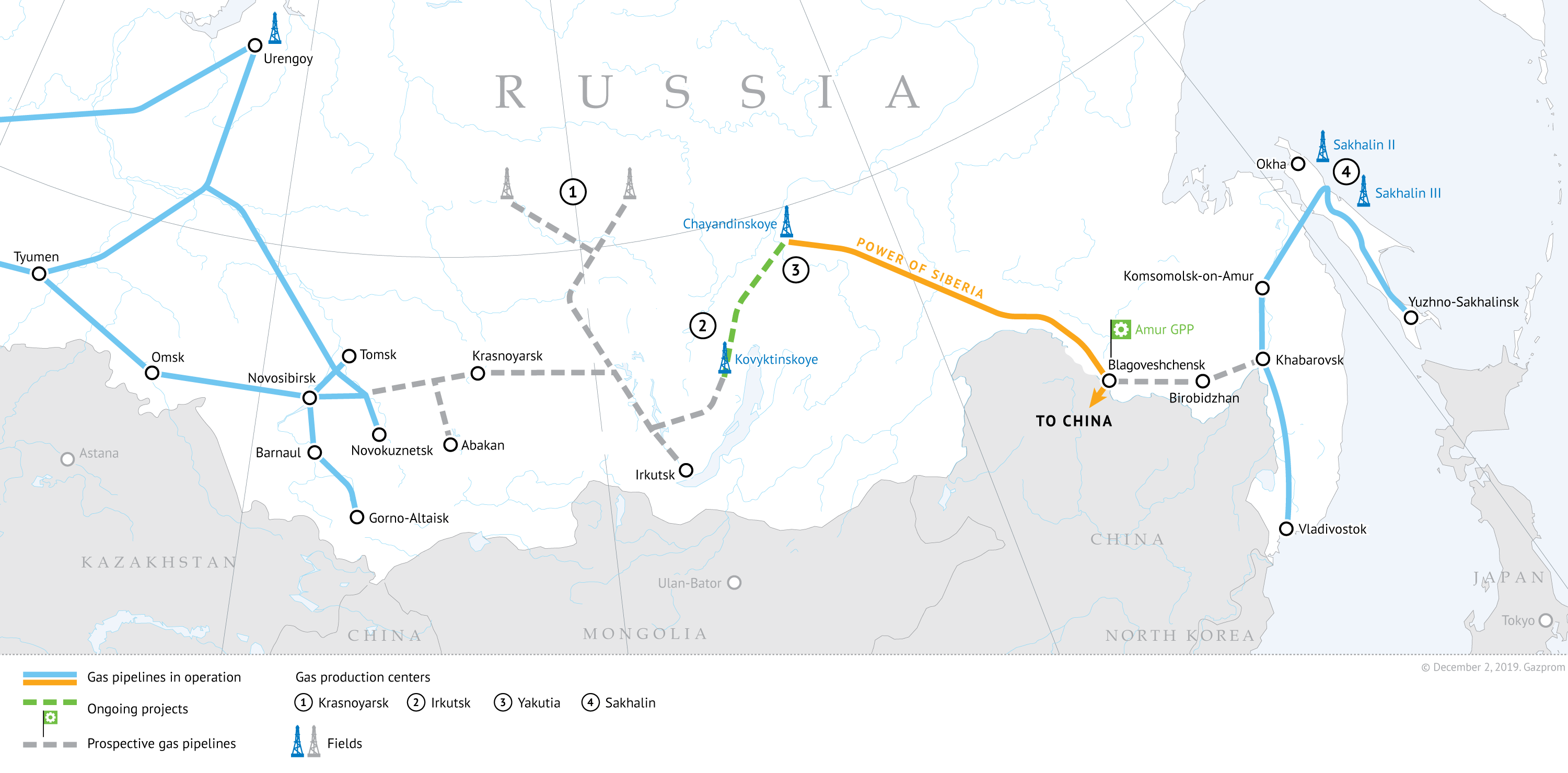

The pipeline through Mongolia would be an alternative to the “Power of Siberia 2” gas pipeline through the Altai mountains, which has been planned since the beginning of the 2000s. In 2015, Gazprom and CNPC signed the Heads of Agreement for pipeline deliveries of natural gas to China via the Western route. The “Power of Siberia 2” gas pipeline with the capacity of 30 billion cubic meters a year was designed to deliver natural gas from Gazprom’s largest gas fields in Western Siberia to the North West of China. Taking advantages of the shortest route between Western Siberia and China, this project would face some technical difficulties as the pipeline is supposed to cross the mountain range in the Altai region. This also makes this project more expensive compared to the Mongolian route that would run through the plain steppe terrain.

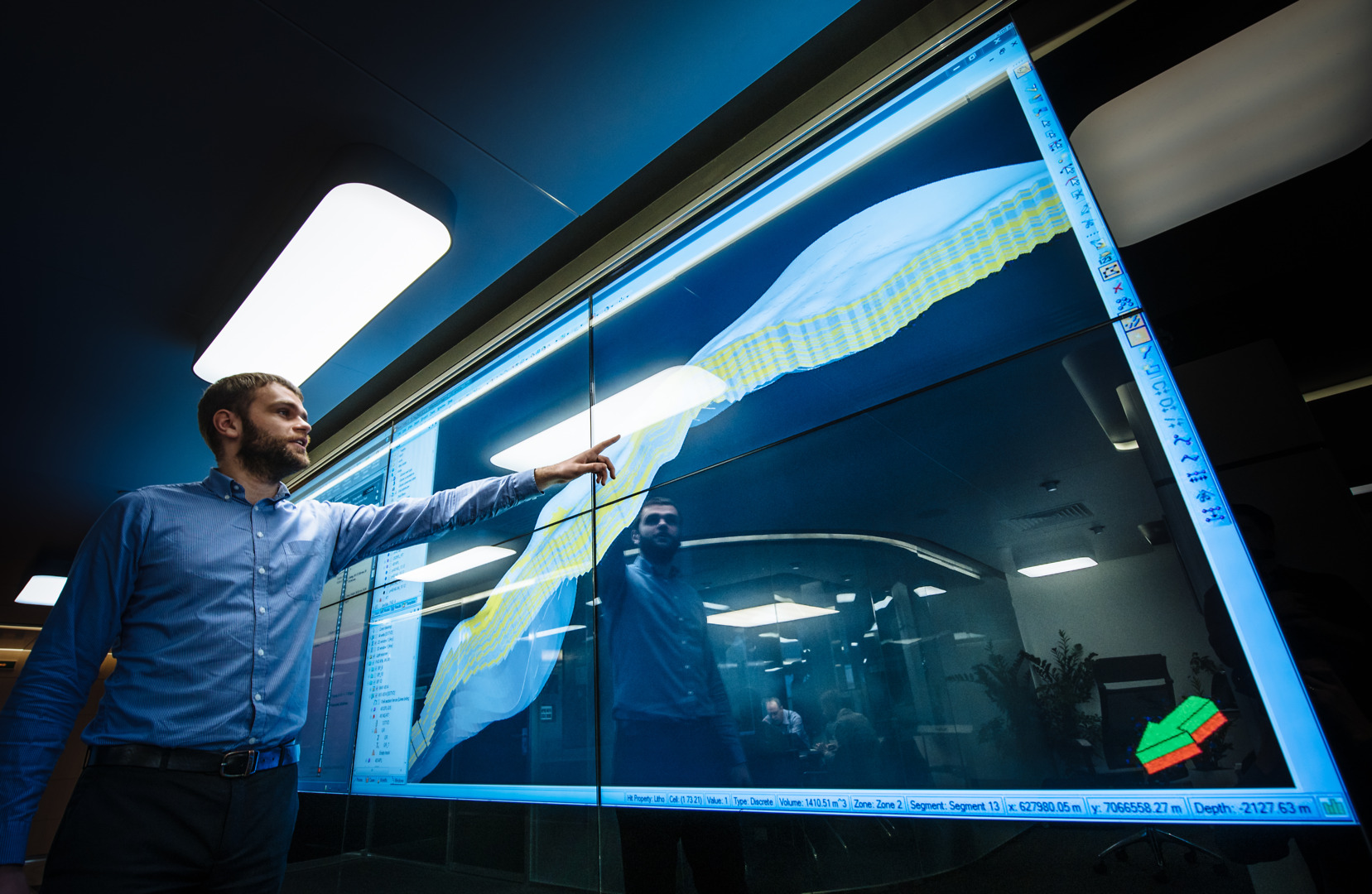

For this reason, the Eastern route was chosen by Gazprom and CNPC as a preferred solution, and the “Power of Siberia” pipeline was commissioned to deliver Russian gas to China. The pipeline came on stream on 2 December 2019, when Russian President Vladimir Putin and his Chinese colleague Xi Jinping launched the pipeline in a teleconference mode. The “Power of Siberia” will transport natural gas from Gazprom’s Eastern Siberian gas fields, Chayandinskoye field in Yakutia and Kovyktinskoye field in the Irkutsk region. According to Gazprom, the company has already commenced the construction of the pipeline’s first section running around 2,200 kilometres from Chayandinskoye gas field to the city of Blagoveshchensk in the Russian Far East. The second phase of the project will include the construction of a section stretching for about 800 kilometres from Kovyktinskoye field to Chayandinskoye field. Gazprom plans to bring Kovyktinskoye gas field on stream in late 2022, so the pipeline construction should be completed by that time.

Natural gas resources and gas transmission system in Eastern Russia. Image credit: Gazprom

Russian energy experts point out, that apart from the technical simplicity the Mongolian route would have other advantages. First of all, it would allow gas deliveries straight to the end customers in Eastern China, including Beijing region, while the Altai route would end in China’s Xinjiang Uygur Autonomous Region, one of the largest gas-producing regions of the PRC. It is also a region where gas from Central Asia is delivered to China via the Central Asia-China gas pipeline. For this reason, once delivered to Xinjiang province Russian gas would compete for access to the Chinese gas transportation system not only with locally produced gas but also with gas supplies from the Central Asian states.

The downsides of the Mongolian route are potential transit risks and higher operating costs due to the transit fees that the Mongolian government would charge for transporting gas through its territory.

During the last 20 years, Gazprom faced several gas transit crises in Europe, first of all, due to the problems with the governments of Ukraine and Belarus. For this reason, the company made a decision to eliminate transit risks by constructing direct subsea pipelines straight to its customers in Western and Southern Europe. Thus, in 2012 Gazprom commenced two lines of the “Nord Stream” offshore gas pipeline with the capacity of 55 billion cubic meters of natural gas a year from Russia to Germany across the Baltic Sea. In 2019 a twin “Nord Stream 2” gas pipeline was constructed, increasing Gazprom’s total export capacity in the region to 110 cubic meters a year. The “TurkStream” offshore pipeline with a capacity of 31.5 cubic meters a year was constructed to deliver Russian gas to the customers in Turkey and Southern Europe. This pipeline is stretching for 930 kilometres from Russia to Turkey across the Black Sea with onshore extension to Bulgaria and the Balkans. The company expects the “TurkStream” to become operational in late 2019.

To mitigate transit risks and avoid additional costs, China also supported only direct transportation routes from Russia. Dmitry Akishin, director of the gas and chemistry practice at VYGON Consulting, notes that until recently Chinese companies were standing against any transit projects for the oil and gas supplies from Russia. Thus, recently China refused to purchase Russian crude oil delivered by rail through Mongolia due to high customs and transit fees. For this reason, a narrow but technically challenging mountainous corridor on the border between Russia and China was considered as an entry point for the “Power of Siberia 2” pipeline. However, Mongolia’s geographical location, its relatively low level of economic development and high dependence on both Russia and China for trade and transportation significantly reduce the country’s bargaining power and make it a convenient and almost risk-free partner for Russia and PRC.

Gas analyst of the Energy Centre at Skolkovo business school Sergey Kapitonov also points out that currently there are no available resources for the Mongolian route as the only developed Kovyktinskoye gas field is considered to be the resource base of the “Power of Siberia” pipeline. However, Dmitry Akishin estimates that it would take around 1-2 years to design the new pipeline and around 4-5 years for the construction. During this time new gas fields in Eastern Siberia may come online and thus the resource problem would be solved. Earlier this year Alexey Miller said that Gazprom plans to intensify its geological exploration activities in Eastern Siberia in 2020-2021. At the moment the company conducts exploration drilling on Abakan, Ilbokichskoye and Imbinskoye gas fields in Krasnoyarskiy Krai, as well as seismic surveys and additional exploration activities in Kovyktinskiy and Handinskiy areas.

Mongolia tried to convince Russia and China to use its territory for oil and gas pipelines for many years. However, due to the perceived threat of transit risks in both Russia and China and higher transportation costs, the pipeline projects through Mongolia were not considered before. The situation changed in September 2019, when Vladimir Putin asked Alexey Miller to “think about” the Mongolian route. He said that this route is not a simple solution but it is quite realistic. He also pointed out that China also started to consider this route. He said that the resource base for this pipeline would be the large gas fields in the Yamal peninsula, so it will help to find the necessary resources to “fill the pipe”. “We are working with Chinese and Mongolian partners on the routes for hydrocarbon exports through Mongolian territory. The work is in progress,” said Vladimir Putin, sited by Kommersant.

Connecting the Western route gas pipeline to the large gas fields of Western Siberia would allow Gazprom more flexibility in reacting to demand patterns and price fluctuation in Europe and Asia, delivering gas to the markets with higher margins. This pipeline would serve as a continental interconnector between western and eastern gas transmission systems in Russia. As a result, Russia will have a large scale, truly continental gas transportation system connecting Siberia’s gas fields to industrial centres in Western Europe and the Asia-Pacific region.